The climate crisis is not a theoretical fact: worldwide we are increasingly dealing with forest fires, floods and extreme weather events. To curb climate change, we need to change course and drastically reduce our CO2 emissions.

That is why, as early as 2021, the International Energy Agency (IEA) recommended that no new fossil source should be approved. The UN Panel on Climate Change (IPCC) came to a similar conclusion in 2022.

Yet there are still companies that are doing exactly the same thing: building new infrastructure to extract extra fossil raw materials, so that we will be stuck with polluting energy for decades to come. Almost half of all new fossil infrastructure worldwide is built by just 15 companies. With their focus on fossil expansion, their business model and strategy are completely at odds with achieving a green and just transition.

As if this wasn't bad enough, this fossil expansion also poses a big risk to the economy Because if we protect the climate and close the fossil infrastructure earlier than the companies had anticipated, those companies will make large losses. These losses are also borne by the banks and investors involved, threatening a new financial crisis.

The commitment of the companies examined in this research to the climate transition cannot be trusted. They have known for decades that climate change is a problem and that they play a major role in it. Yet, they use their gigantic profits to justify the expansion of the fossil infrastructure and shareholder payments. They try to justify this with a haze of greenwashing and false solutions, but every now and then they scrap their climate plans. These are not reliable partners that you can talk to to push them in the right direction. It's far too late for that. Under pressure from the market, they have shown where their priorities lie: with their profits and their shareholders, not with the climate.

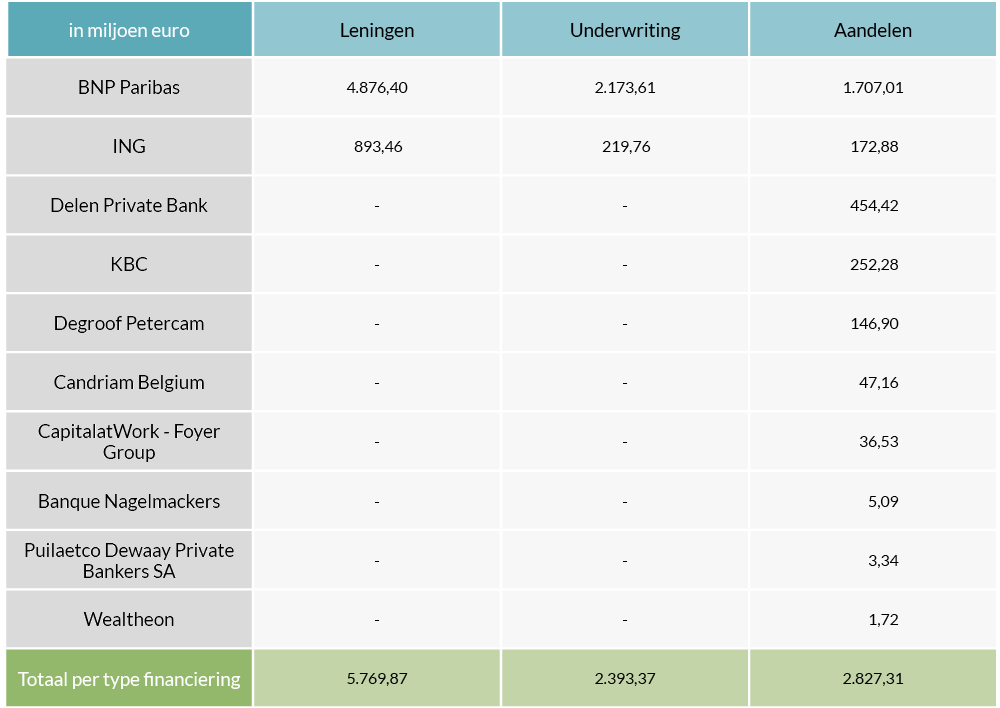

Despite all this, our research shows that financial players active in Belgium have continued to support these 15 largest fossil fuel expanders. From the beginning of 2021 until July 2023, almost 11 billion euro has been transferred in various forms of financial support. Despite their so-called climate ambitions, despite all the evidence that these 15 companies are a danger to the planet and humanity, banks and investors active in Belgium continue to support the world's largest fossil fuel expanders. This means that they too prefer profit over a just climate transition, while their decisions have major social consequences.

That is why we need legislation. Fossil fuel companies and banks will not take action on their own or will take action far too slowly. In the memorandum that FairFin drew up for the 2024 elections, we proposed a series of measures that we believe politicians should include in their party program. One of those demands is legislation at the European level that prohibits investments in fossil expansion. This study proves once again how urgent the need is for such legislation. Because every euro that flows into the construction of new fossil infrastructure is a step further away from a just climate transition.

To advocate for this, FairFin took action on 17 November at the Cabinet of Finance in Brussels. Because 11 billion euros for fossil expansion? That has to change. Do you agree with this? Send a letter of complaint to the party leaders and help put pressure on a financial system that really works for people and the planet.