Fair Finance Thailand publishes 7th policy assessment of Thai banks

In 2024, Fair Finance Thailand conducted an assessment of the policies of 11 Thai financial institutions, including 8 of Thailand’s largest commercial banks and 3 state-owned specialized financial institutions, which were disclosed to the public. This is the 7th year that the Fair Finance Guide International has been applied in Thailand, based on the Fair Finance Guide International 2023 criteria, using the information disclosed to the public by the banks as of September 2024, together with additional information disclosed to the public by the banks during the feedback period between the research team and each bank between September and October 2024.

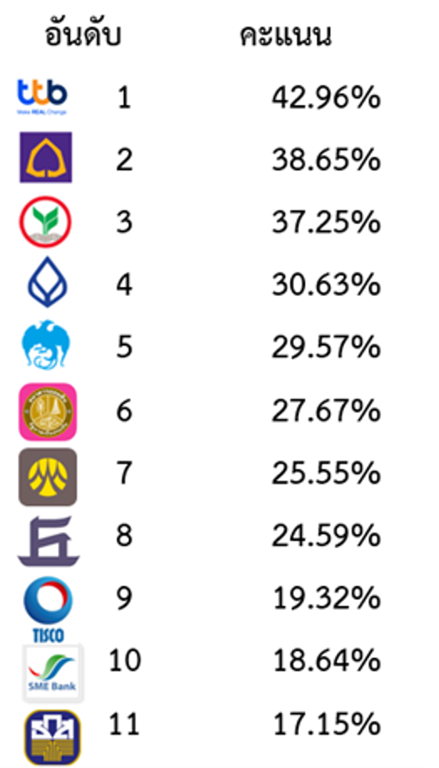

The results of the assessment of the policies of 11 Thai banks in 13 categories for the year 2024 using information disclosed by the banks to the public as of October 31, 2024, found that the banks' average scores increased from 25.94% in 2023 to 28.36% in 2024.

The banks with the top 5 scores were:

1. Thanachart Bank (42.96%)

2. Siam Commercial Bank (38.65%)

3. Kasikorn Bank (37.25%)

4. Bangkok Bank (30.63%)

5. Krung Thai Bank (29.57%)

The bank rankings changed from second place onwards, with Siam Commercial Bank moving from fourth to second place, replacing Kasikornbank, and Bangkok Bank moving from fifth to fourth.

The reason why the average score of the 11 banks increased was because many banks revised their policies to be more in line with the assessment criteria and made them public or signed up to international standards or guidelines for social and environmental operations, such as the UN Global Compact (UNGC) or the Equator Principles. In addition, the Coalition improved the scoring to be more appropriate as a result of the banks' feedback and participation processes, resulting in an increase in the average score this year.