New policy assessment from Fair Finance Japan

Fair Finance Guide Japan (FFGJ), a coalition of 4 Japanese non-profit organizations (NGOs), released its 12th policy assessment assessing Environmental, Social, and Governance (ESG) policies of Japanese financial institutions.

Among the six evaluated Japanese major banks, Mizuho scored the highest with 38/100, followed by Norinchukin Bank which scored 37. Mitsubishi UFJ Financial Group (MUFG) is in the third position scoring 35. Sumitomo Mitsui Banking Corporation (SMBC)’s score dropped from 30 last year to 29 points this year due to its withdrawal from the Equator Principles, which are environmental and social risk management standards for financing large-scale development projects.

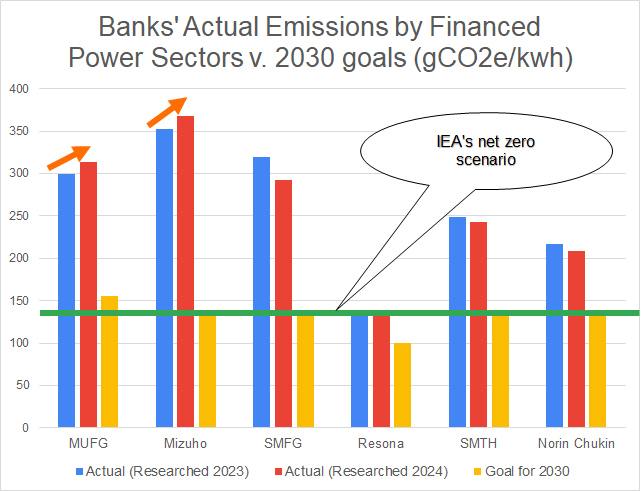

As in the previous year, Resona performed the best in terms of having the lowest financed power emissions at 139 gCO2e/kWh, which is almost aligned with the 1.5-degree Celsius target by 2030.

On the other hand, Mizuho’s financed emissions increased from 353gCO2e/kwh (FY2021) to 368gCO2e/kwh (FY2022), and MUFG’s financed emissions increased from 299gCO2e/kWh (FY2021) to 313gCO2e/kWh (FY2022), clearly running against the 1.5-degree Paris target goal.

Additionally, Mizuho, MUFG, and SMBC have newly adopted policies to confirm the environmental and social considerations of combustion materials when financing biomass power generation projects. Notably, SMBC has established a policy to ensure that sustainable combustion materials do not involve the logging of primeval forests and/or human rights violations are recognized to have occurred in the production of the materials (*1).

With Deep Sea Mining (DSM) as an emerging new frontier for mineral extraction that is already having significant impact on marine ecosystems and coastal communities, Deutsche Bank announced in September 2024 a new policy banning investment and financing in DSM projects (*2). However, none of the Japanese banks have established any such policies.

SMBC needs to rejoin the Equator Principles, and Mizuho and MUFG must steadily reduce their financed power sector emissions to achieve their 2030 targets. Each financial institution should also strengthen their sector policies on biomass power generation and DSM.

*1: https://www.smfg.co.jp/english/sustainability/group_sustainability/

*2: https://www.db.com/news/detail/20240925-deutsche-bank-strengthens-its-ocean-protection-policies-under-backblue-initiative?language_id=1

Contact:

Japan Center for a Sustainable Environment and Society (JACSES)

Yuki Tanabe (tanabe@jacses.org)

Ayako Honkawa (honkawa@jacses.org)