Fair Finance Germany's Fair Finance Guide 8.0 launches

Latest policy assessment finds progress in transparency and sustainability, but also reveals new deficits

-

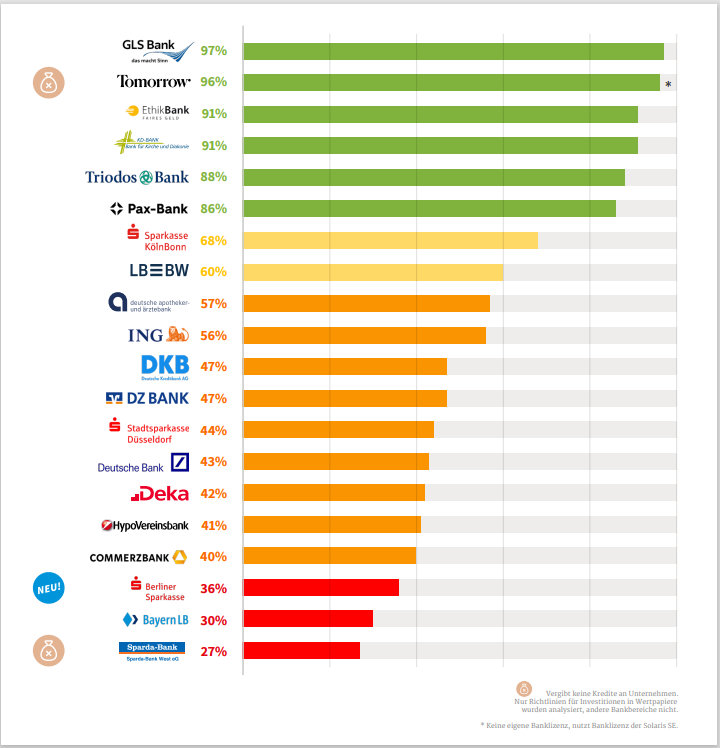

Alternative banks and church banks GLS Bank, EthikBank, Tomorrow[1], KD-Bank, Triodos Bank and Pax-Bank are the best performers

-

Berliner Sparkasse analysed for the first time

-

Many German banks do not yet have deep-sea mining on their radar and are lagging behind banks in other European countries

-

9 out of 20 banks have no policy for deep-sea mining

-

More transparency and sustainability in banks, with the exception of the defence sector

-

Several banks are watering down their arms policies and supporting companies that export weapons to warmongering regimes in violation of international humanitarian law

For the eighth time, the "Fair Finance Guide Deutschland" (FFG), a project coordinated by the NGO Facing Finance, has examined whether and how German banks respect social and ecological standards. In cooperation with the SÜDWIND Institute and EarthLink, the FFG examines the published financing and investment guidelines of 20 banks for compliance with international sustainability standards on the basis of 254 criteria from 15 subject areas[2]. The aim of the FFG is to create transparency and comparability for bank customers with regard to the social and environmental performance of German banks. This is intended to protect consumers from possible greenwashing. "In addition, we are entering into a constructive dialogue with the banks in order to make their financing and investment guidelines more sustainable and transparent," adds Luca Schiewe, FFG project coordinator at Facing Finance.

Best-performing: The alternative and church banks GLS Bank, Tomorrow, Ethikbank, KD-Bank, Triodos Bank and Pax-Bank (86-97%) once again performed, while Sparda-Bank West[3] (27%) and Bayerische Landesbank (30%) bring up the rear. Berliner Sparkasse was evaluated for the first time and reaches 36%, which is higher than the results for other newcomers in the past,but still has room for improvement. The largest improvements were recorded by Sparda-Bank West (+17%), DekaBank (+6%), DZ Bank (+5%), Tomorrow (+5%) and Stadtsparkasse Düsseldorf (+5%). Overall, German banks are improving in terms of transparency and sustainability, but are lagging behind Swedish, Belgian or Dutch banks, as the FFG in other countries shows.

"It is very pleasing that such significant progress has been made, especially at the NRW banks. Due to its criteria, the FFG enables good transparency and thus manages to increasingly sensitize banks and citizens to corresponding sustainability guidelines," says Katja Winter from the North Rhine-Westphalia Foundation for Environment and Development, which supports FFG Germany with a focus on North Rhine-Westphalia.

"The importance of the Fair Finance Guide should not be underestimated. It is the only non-profit source of information that has been around for years and provides consumers who want to know what is happening with their money with reliable and transparent information," says Ulrike Lohr, Sustainable Finance Officer at the SÜDWIND Institute. "We also appreciate the broad methodological approach to environmental, social and governance issues, which covers important social issues such as human and labour rights due diligence, which are often ignored by sustainable finance practitioners. By addressing new topics such as deep-sea mining, the FFG is keeping pace with global sustainability challenges."

Deep-sea mining is increasingly becoming a threat to the oceans and a risk for lenders. For this reason, the FFG has also analysed deep-sea mining for the first time. Andy Whitmore of the Deep Sea Mining Campaign states: "The FFG's research shows that a narrow majority of the German banks surveyed, namely 11 out of 20, exclude direct financing of deep-sea mining projects.[4] This is encouraging, as these banks oppose the exploitation of the deep sea. However, some of these banks continue to finance and invest in companies such as the Deme Group with its deep-sea exploration subsidiary Global Sea Mineral Resources (GSR)[5]. In total, 8 of the 20 banks were in[6] financial relationships with 7 companies[7] who are active in deep-sea mining, among other things."

Although German banks are slowly becoming more transparent and responsible on most of the topics examined, there is one exception: weapons. Since the beginning of the Ukraine war, various banks have[8] has relaxed its guidelines in the arms sector, often citing the need to equip the armed forces of EU countries. However, most banks lack a differentiated set of rules that limits financing to equipping the armed forces within the EU or banning weapons[9] and arms exports to war zones.

No bank has softened its rules more than the Bayerische Landesbank (BayernLB). Previously, the financing of armaments projects was excluded, and general corporate financing was only possible for companies with a maximum of 20% arms turnover. Following two policy changes (2023 and 2024), BayernLB now finances arms exports directly and has no exclusion from general corporate financing of companies that manufacture banned weapons or whose arms exports fuel wars in Yemen, Syria, Gaza, Myanmar or Libya in violation of international law. "Banks should align themselves with internationally binding treaties and exclude companies that produce anti-personnel mines or cluster bombs or violate the Arms Trade Treaty (ATT), which prohibits arms shipments that are knowingly used for war crimes," demands Thomas Küchenmeister, managing director of Facing Finance, a member of the International Campaign to Ban Anti-Personnel Mines ICBL (Nobel Peace Prize 1997).

All ratings and the ranking for download as well as the bank statements on the FFG.

[1] Tomorrow does not have a banking license, but uses the banking license of its cooperation partner Solaris SE. In addition, Tomorrow does not grant loans to companies, so only the FFG's own investments and asset management were evaluated.

[2] Climate change, corruption, gender equality, human rights, labour rights, nature, taxation, transparency & accountability, armaments, food, forestry, mining, manufacturing, power generation, oil & gas.

[3] Sparda-Bank West does not grant loans to companies. Therefore, the FFG only assessed the guidelines of its own investments, other banking divisions did not.

[4] The 11 banks are Apobank, Deutsche Bank, DZ Bank, Ethikbank, GLS, KD-Bank, Pax-Bank, Sparkasse Köln-Bonn, Tomorrow, Triodos, UniCredit.

[5] Deme's investors include Deutsche Bank and DZ Bank, while Deutsche Bank, DekaBank, ING are investing in Deme's majority owner Ackermans & Van Haaren NV.

[6] The 8 banks are Deutsche Bank, DZ Bank, DekaBank, ING, UniCredit, Commerzbank, BayernLB, LBBW.

[7] The 7 companies are Deme, Ackermans & Van Haaren, CMRELTD, Bosch Ltd, Bauer, Continental, Noble Corporation.

[8] E.g. Landesbank Baden-Württemberg (LBBW) or Deutsche Bank (with the asset manager DWS).

[9] E.g. cluster bombs, anti-personnel mines, white phosphorus or nuclear weapons.