Swedbank stops fossil loans after protests

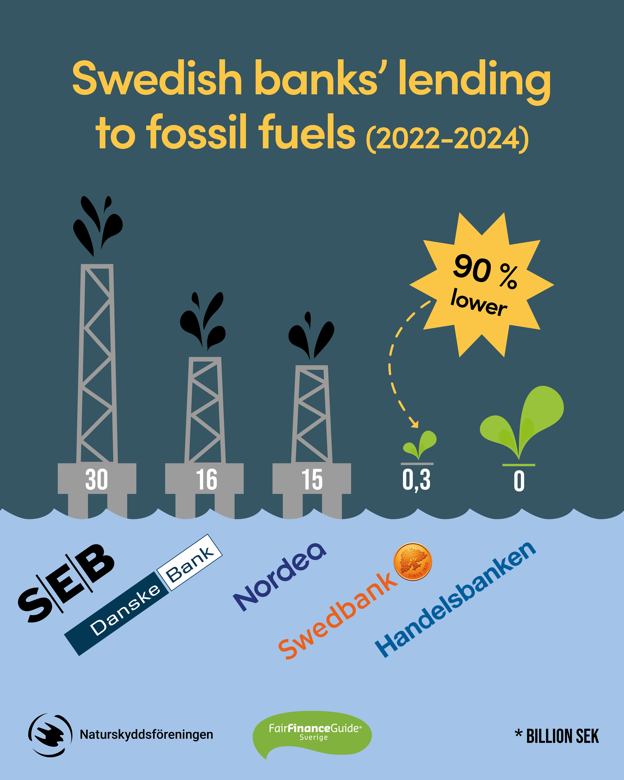

After protests from thousands of Swedish bank clients, Swedbank has almost completely stopped new loans to fossil fuel companies. Meanwhile, SEB, Danske Bank, and Nordea have continued to pour over 60 billion SEK into fossil fuel companies, including to upstream companies that explore for more fossil fuel reserves. This is revealed in a new report by Fair Finance Guide Sweden and its partner Swedish Society for Nature Conservation.

"The banks must stop financing the search for more fossil fuels; it completely undermines climate actions around the world. I don't think Swedish bank clients appreciate that their money is being used this way," says Jakob König, who leads Fair Finance Guide in Sweden.

The new report Banking on Thin Ice 3 shows that SEB, Nordea, and Danske Bank have provided over 60 billion SEK in new loans to fossil fuel companies in the last two years, despite their promises of climate responsibility. This is nearly four times the total climate and environmental budget of the Swedish government for 2025. Almost 22 billion SEK has gone to companies drilling for new oil and gas reserves, which contradicts the climate goals of the Paris Agreement.

"The banks have long responded to the criticism by claiming they are helping oil companies to transition. But these companies are moving in the wrong direction by continuing to expand the extraction. The banks must stop supporting this, just as Handelsbanken and Swedbank have done," says Karin Lexén, Secretary General of the Swedish Society for Nature Conservation.

Eight billion SEK of the Swedish loans have gone to companies searching for more oil reserves in the Norwegian Arctic. Here the environment is particularly sensitive, and species such as seals, dolphins, and whales are threatened by the extraction. Last year, Norway quadrupled the number of extraction licenses sold in the Arctic compared to the previous year. A majority of the licenses were purchased by Norwegian Aker BP, which is also the oil company that has received the largest loans from Swedish banks, totaling 7 billion SEK from SEB and Nordea.

The banks have also provided six billion SEK to companies drilling for oil in African countries. Extraction there is becoming increasingly risky as companies are moving to ever greater ocean depths to find new reserves. In Namibia, oil drilling occurs at depths of up to 3,000 meters. Other countries where Swedish-financed companies are active include Congo, Ghana, Nigeria, and Equatorial Guinea.

The report shows however that Swedbank has stopped its loans to almost all fossil fuel companies, just as Handelsbanken did two years ago. This is likely a result of the thousands of client protests that the previous report sparked, as well as campaign work, including resolutions at the banks' shareholder meetings. Swedbank and Handelsbanken are now among a few banks worldwide that have stopped lending to expanding oil companies.

"It’s encouraging that another major Swedish bank has become an international role model for sustainable financing. Now more banks must follow suit and take responsibility because there are still large fossil companies receiving loans to continue operations that worsen the climate crisis," says Karin Lexén, Secretary General of the Swedish Society for Nature Conservation.

ENDS

Contact persons:

Jakob König, expert and project leader for Fair Finance Guide, +46730379293, jakob@fairfinanceguide.se

Karin Lexén, Secretary General of the Swedish Society for Nature Conservation, available via press officer Anna Havula: +46708703700, press@naturskyddsforeningen.se

About the report

The report Banking on Thin Ice 3 covers the nine largest banks in the Nordic countries and maps their lending between July 2022 and June 2024 to a total of 590 companies active in coal, oil, and gas sector. Behind the report are Fair Finance Guide Sweden, the Swedish Society for Nature Conservation, and Action Aid in Denmark.