About us

Race to the top

The Fair Finance Methodology

Newsletters

Fair Finance Asia

Contact

About us

Fair Finance International (FFI) is an international civil society network of over 150 CSO partners and allies, coordinated by Oxfam Novib, that seeks to strengthen the commitment of banks and other financial institutions to social, environmental and human rights standards.

As a global network we use a rigorous methodology to assess, report on, and campaign for more responsible investment policies & practices. By benchmarking the investment policies and practices of financial institutions in critical areas such as human rights and climate impact, we enable consumers, policy holders and citizens to demand more socially responsible, fair, and sustainable investments. An overview of the methodology and research process can be found here.

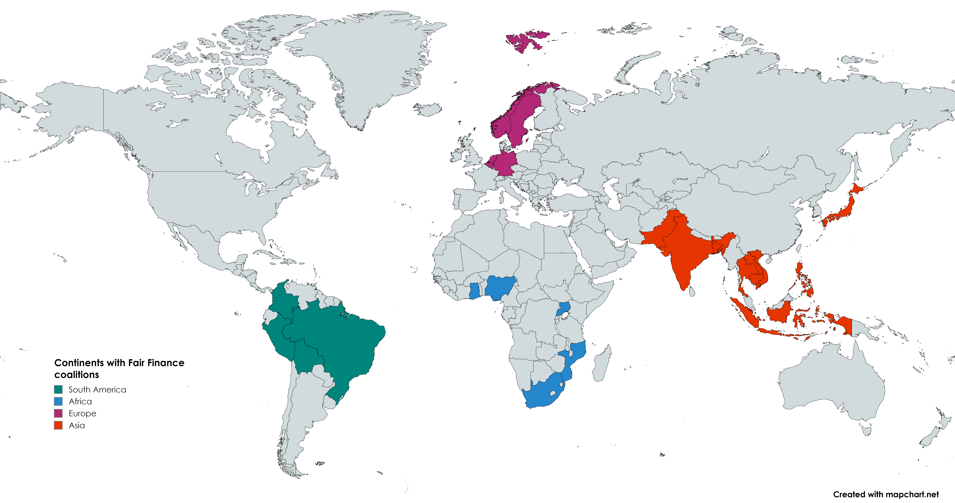

Since 2014 a total of 159 banks and investors in 16 countries in 4 continents have been assessed using the Fair Finance Methodology: 131 banks, 20 insurance companies and 8 pension funds.

FFI builds on a pioneering model developed in the Netherlands since 2009, followed by a similar initiative in Brazil in 2011, which demonstrated the potential for bringing about positive change in the ways the financial sector invests.

The FFI network is currently active in 24 countries across 4 continents:

Bangladesh, Belgium, Bolivia, Brazil, Cambodia, Colombia, Germany, Ghana, India, Indonesia, Japan, Lao PDR, Netherlands, Nigeria, Norway, Pakistan, Peru, Southern Africa (South Africa and Mozambique), Sweden, Thailand, The Philippines, Uganda and Vietnam. Each coalition is composed of civil society groups with expertise in areas relevant to monitoring and assessing the financial sector, and often includes development and human rights organizations, environmental groups, and consumer organizations. All Asian coalitions work together on a regional base within the Fair Finance Asia program, working in close coordination with FFI.

Race to the top

Fair Finance International is a global network assessing, reporting on and campaigning for more responsible investment policies and practices by financial institutions. We enable consumers, policy holders and citizens to make financial institutions more socially responsible, fair, and sustainable by benchmarking their investment policies and practices against international standards in critical areas such as human rights and climate impact.

The aim of Fair Finance International is to initiate a ‘race to the top’ between banks and financial institutions on Environmental, Social, Governance (ESG), transparency issues and other human rights standards. Ideally, this brings about a self-reinforcing process whereby banks continuously raise their adherence to those standards, ultimately resulting in more sustainable lending, investments and asset management all over the world.

Fair Finance Methodology

A key part of our Fair Finance work is our comprehensive and rigorous Methodology. Developed by our network with policy research experts Profundo, and other stakeholders, the methodology is used to assess Financial Institutions' approach to sustainability across 19 influential themes, including corruption, human rights, and climate change. By assessing the publicly available information on how Financial Institutions incorporate sustainability considerations into their operations, we score them on social and environmental responsibility. This data forms the basis of constructive fact-based dialogue across the sector for more responsible and sustainable financial policies and practices.

The Methodology is aligned to international standards and can be applied to commercial banks, public banks, insurance companies and pension funds. Assessments carried out by Fair Finance coalitions usually examine 8 core themes: Climate Change; Corruption; Human Rights; Labour rights; Biodiversity; Tax; Transparency; Gender.

The other optional topics within the assessment are animal welfare; arms; health; food; forestry; mining; oil and gas; corruption, power generation; consumer protection; financial inclusion; remuneration.

Fair Finance coalitions operating in Asia, Latin America, Africa and Europe, use this methodology to assess the financial institutions in their countries on a regular basis. Scores are given to the financial institutions and published on the national Fair Finance websites, where citizens and policymakers can see how financial institutions compare.

The Methodology is updated every two years to remain current with the latest international standards and to incorporate new data from across our global network. The current Methodology (March 2025) refers to over 422 international standards and criteria and is the 8th update since the first international methodology was developed in 2014.

An overview of the methodology and research process can be found here.

Newsletters

The Fair Finance International Quarterly Newsletter provides updates and highlights of the great work and achievements taking place within our global network.

Subscribe here to receive the Quarterly newsletter.

See previous newsletters here.

The newsletter can also be viewed on LinkedIn. Read and subscribe here.

Fair Finance Asia

Fair Finance International collaborates and partners with Fair Finance Asia, a regional network of over 90 Asian civil society organizations committed to ensuring that financial institutions’ funding decisions in the region respect the social and environmental well-being of local communities.

Through our cross-collaboration we support sustainable financing initiatives and knowledge sharing, and strengthen the evidence base in cases of harmful investments to better hold financial institutions to account. By connecting these diverse national, regional and global perspectives the Fair Finance network as a whole can advise on and advocate for meaningful changes to financing systems, with positive results for citizens and communities.

![]()

Contact

Want to know more about our initiative or interested in joining?

Fair Finance International is expanding to new countries and regions. To learn more about how your organization can join or start a Fair Finance Coalition, please contact Fair Finance International at info@fairfinanceguide.org

You can also subscribe for our Quarterly Newsletter which highlights some of the great work and achievements going on in the network. Subscribe here.

Fair Finance International is initiated by Oxfam Novib and financially supported by Sida.